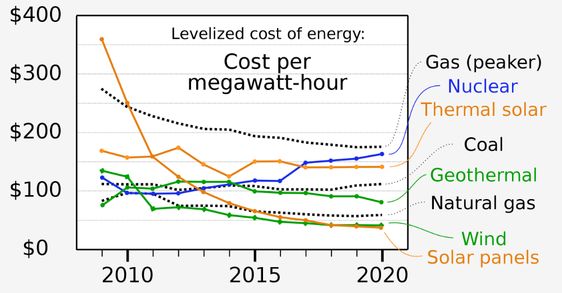

After 13 years of delay, lawsuits, and enormous increased costs (from “fixed price” €3 billion to an estimated €11 billion), the Olkiluoto 3 nuclear reactor marks no quick solution to Europe’s energy crisis. Once fully operational, Olkiluoto 3, operated by TVO (Teollisuuden Voima), is expected to meet 14% of Finland’s electricity demand, reducing the need for imports from Russia, Sweden, and Norway. LCOE for the OL3 reactor alone is estimated at 42 EUR/MWh, this means nuclear energy is not cheap compared to renewable energy.

Olkiluoto Nuclear Power Plant

From Wikipedia, the free encyclopedia

The Olkiluoto Nuclear Power Plant is one of Finland’s two nuclear power plants, the other being the two-unit VVER Loviisa Nuclear Power Plant. The plant is owned and operated by Teollisuuden Voima (TVO), a subsidiary of Pohjolan Voima, and is located on Olkiluoto Island, on the shore of the Gulf of Bothnia, in the municipality of Eurajoki in western Finland, about 20 kilometers from the town of Rauma and about 50 kilometers from the city of Pori.

The Olkiluoto plant consists of two boiling water reactors (BWRs), each producing 890 MW of electricity, together comprising 22% of the country’s electricity generation for 2020.

The third reactor, Unit 3, at 1,600 MW, will by itself satisfy 14% of the country’s electricity demand. Unit 3 is an EPR reactor and has been under construction since 2005.

Olkiluoto 3

In February 2005, the Finnish government gave its permission to TVO to construct a new nuclear reactor, making Finland the first Western European country in 15 years to order one. The construction of the unit began in 2005. The start of commercial operation was planned for 2010 but has been pushed back several times.

Olkiluoto 3 is the first EPR, which is a type of third-generation PWR, to have gone into construction. It will have a nameplate capacity of 1600 MW. Japan Steel Works and Mitsubishi Heavy Industries manufactured the unit’s 526-ton reactor pressure vessel.

At the start of construction, the main contractor was Areva NP (now Framatome, after the sell-off mentioned below), a joint venture of Areva and Siemens. However, in 2009, Siemens sold its one-third share of Areva NP to Areva, which is now the main contractor. Siemens remained on the project as the subcontractor with the main responsibility for constructing the turbine hall. Areva sold its majority stake in Framatome (previously Areva NP), its nuclear reactor and fuel business, to Électricité de France.

According to TVO, the construction phase of the project would create a total of about 30,000 person-years of employment directly and indirectly; that the highest number of on-site employees has been almost 4,400; and that the operation phase would create 150 to 200 permanent jobs. A 90 MW battery storage is scheduled for 2022.

On 8 December 2021, the company submitted its application to Finland’s Radiation and Nuclear Safety Authority asking permission to start up Unit 3 and to move forward with initial testing of the unit. This was granted on 16 December 2021. The first criticality of the OL3 EPR plant unit was reached on 21 December 2021. An unplanned automatic trip occurred on 14 January 2022, delaying connection to the national grid to February 2022. The electricity production of Olkiluoto’s third nuclear power plant unit started on Saturday, 12 March 2022, at 12.01 p.m. OL3’s regular electricity production starts in July 2022.

Cost

The main contractor, Areva, is building the unit for a fixed price of €3 billion, so in principle, any construction costs above that price fall on Areva. In July 2012, those overruns were estimated at more than €2 billion, and in December 2012, Areva estimated that the full cost of building the reactor would be about €8.5 billion, well over the previous estimate of €6.4 billion. Because of the delays, TVO and Areva both sought compensation from each other through the International Court of Arbitration.

In October 2013, TVO’s demand for compensation from Areva had risen to €1.8 billion, and Areva’s from TVO to €2.6 billion. In December 2013, Areva increased its demand to €2.7 billion. On 10 March 2018 French newspaper Le Monde announced that Areva and TVO had reached an agreement. A day later, TVO confirmed that Areva would pay €450 million in compensation for the delays and lost income. The agreement would settle all legal actions between the two companies. With the settlement, TVO disclosed its total investment to be around €5.5 billion. Areva had accumulated losses of €5.5 billion. The total cost of the project, therefore, is estimated to be €11 billion.

Between 2013 and 2017 OL1 and OL2 produced between 13,385 GWh and 14,740 GWh per year at capacity factors between 87.2% and 96%. OL3 is expected to produce an additional 12,000-13,000 GWh annually. Even taking into account all OL3 construction delays the long-term LCOE target for all three plants is 30 EUR/MWh. LCOE for the OL3 reactor alone is estimated at 42 EUR/MWh.

Levelized cost of energy

The levelized cost of energy (LCOE), or levelized cost of electricity, is a measure of the average net present cost of electricity generation for a generating plant over its lifetime. It is used for investment planning and to compare different methods of electricity generation on a consistent basis. The LCOE “represents the average revenue per unit of electricity generated that would be required to recover the costs of building and operating a generating plant during an assumed financial life and duty cycle”, and is calculated as the ratio between all the discounted costs over the lifetime of an electricity generating plant divided by a discounted sum of the actual energy amounts delivered. Inputs to LCOE are chosen by the estimator. They can include the cost of capital, decommissioning, fuel costs, fixed and variable operations and maintenance costs, financing costs, and an assumed utilization rate.

Calculation

The LCOE is calculated as:

| It | : | investment expenditures in the year t |

| Mt | : | operations and maintenance expenditures in the year t |

| Ft | : | fuel expenditures in the year t |

| Et | : | electrical energy generated in the year t |

| r | : | discount rate |

| n | : | expected lifetime of system or power station |

Note: caution must be taken when using formulas for the levelized cost, as they often embody unseen assumptions, neglect effects like taxes, and may be specified in real or nominal levelized cost. For example, other versions of the above formula do not discount the electricity stream.

Typically the LCOE is calculated over the design lifetime of a plant and given in currency per energy unit, for example, EUR per kilowatt-hour or AUD per megawatt-hour.

LCOE does not represent the cost of electricity for consumers and is most meaningful from the investor’s point of view. Care should be taken in comparing different LCOE studies and the sources of the information as the LCOE for a given energy source is highly dependent on the assumptions, financing terms and technological deployment analyzed.

Thus, a key requirement for the analysis is a clear statement of the applicability of the analysis based on justified assumptions. In particular, for LCOE to be usable for rank-ordering energy-generation alternatives, caution must be taken to calculate it in “real” terms, i.e. including adjustment for expected inflation.

5 Comments

Pingback: minecraft happymod

Pingback: รับจำนำรถใกล้ฉัน

Pingback: car detaling

Pingback: cheap csgo cheats

Pingback: วิธีเล่นไพ่ยี่กี