Jason Dedrick, Syracuse University; Greg Linden, University of California, Berkeley, and Kenneth L. Kraemer, University of California, Irvine

Crack open an iPhone and you’ll begin to see why President Donald Trump’s ongoing trade war with China doesn’t make sense.

On paper, imports of the popular smartphone and other goods from China look like a big loss to the U.S. The president certainly thinks so and has often cited the massive U.S.-China bilateral trade deficit – US$420 billion in 2018 – as a reason to fight his trade war.

When an iPhone X arrives in the U.S., it adds about $370 – its factory cost – to the deficit. All told, iPhones add tens of billions of dollars a year to the U.S. deficit with China, which is the gap between imports and exports. But, thanks to the globe-spanning supply chains that run through China, trade deficits in the modern economy are not always what they seem.

Our research on the breakdown of an iPhone’s costs – where all its components and labor come from and who actually benefits – shows that China gets less value from its iPhone exports than you might think.

Who really makes the iPhone?

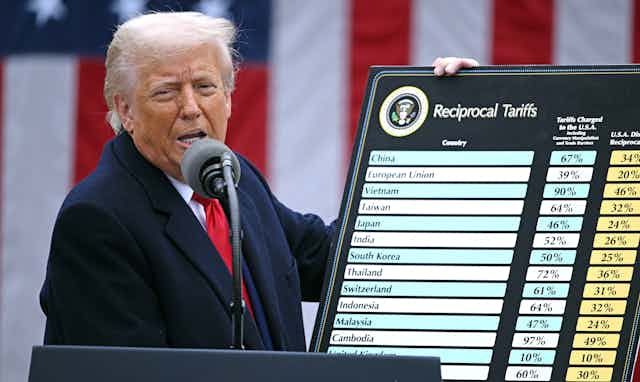

As part of his escalating trade war, Trump says he may soon slap 25% tariffs on $300 billion in imports from China. That would mean virtually all products shipped to the U.S. from China are subject to high tariffs.

Apple’s iPhone, which is assembled in China, would be among those affected by the new tariffs. Apple is urging the administration to halt its plans, which the company says would hurt its sales.

Trump seems to believe that imports of iPhones, televisions and everything else from China represent money it’s “taking out” of the U.S. and using to “rebuild” China.

To see how much value China is actually getting, let’s examine an older model of the iPhone – the iPhone 7 – a little more closely.

Start with the most valuable components that make up an iPhone: the touch-screen display, memory chips, microprocessors and so on. They come from a mix of U.S., Japanese, Korean and Taiwanese companies, such as Intel, Sony, Samsung and Foxconn. Almost none of them is manufactured in China. Apple buys the components and has them shipped to China; then they leave China inside an iPhone.

So what about all of those famous factories in China with millions of workers making iPhones? The companies that own those factories, including Foxconn, are all based in Taiwan. Of the factory-cost estimate of $237.45 from IHS Markit at the time the iPhone 7 was released in late 2016, we calculate that all that’s earned in China is about $8.46, or 3.6% of the total. That includes a battery supplied by a Chinese company and the labor used for assembly.

The other $228.99 goes elsewhere. The U.S. and Japan each take a roughly $68 cut, Taiwan gets about $48 and a little under $17 goes to South Korea. And we estimate that about $283 of gross profit from the retail price – about $649 for a 32 GB model when the phone debuted – goes straight to Apple’s coffers.

We believe you’d get a similar a breakdown from newer iPhones as well.

In short, China gets a lot of low-paid jobs, while the profits flow to other countries.

The trade balance in perspective

A better way of thinking about the U.S.-China trade deficit associated with one iPhone would be to only count the value added in China, $8.50, rather than the $240 that shows up as a Chinese import to the U.S.

Scholars have found similar results for the broader U.S.-China trade balance, although the disparity is less extreme than in the iPhone example. Of the 2017 trade deficit of $375 billion, probably one-third actually involves inputs that came from elsewhere – including the U.S.

The use of China as a giant assembly floor has been good for the U.S. economy, if not for U.S. factory workers. By taking advantage of a vast, highly efficient global supply chain, Apple can bring new products to market at prices comparable to its competitors, most notably the Korean giant Samsung.

Consumers benefit from innovative products, and thousands of companies and individuals have built businesses around creating apps to sell in the app store. Apple uses its profits to pay its armies of hardware and software engineers, marketers, executives, lawyers and Apple store employees. And most of these jobs are in the U.S.

If the next round of tariffs makes the iPhone more expensive, demand will fall – hence Apple’s plea to the administration. Meanwhile Samsung, which makes over half its phones in Korea and Vietnam, with a lower share of U.S. parts, will not be affected as much by a tariff on goods from China and will be able to gain market share from Apple, shifting profits and high wage jobs from the U.S. to South Korea.

Put another way, research has shown globalization hurt some Americans while it made life better for many others. Putting globalization in reverse with tariffs will also create winners and losers – and there could be far more of the latter.

AP Photo/Andy Wong

Why not make the iPhone in America?

When we discuss these topics with policymakers and the media, we’re often asked, “Why can’t Apple just make iPhones in the U.S.?”

The main problem is that the manufacturing side of the global electronics industry was moved to Asia in the 1980s and 1990s. Companies like Apple have to deal with this reality.

As the numbers we’ve cited make clear, there’s not much value to be gained for the U.S. economy or its workers from simply assembling iPhones here from parts made in Asia.

While it’s possible to do so, it would take at least a few years to set it up, cost more per unit than production in Asia, and require a lot of carrots and sticks from policymakers to get the many companies involved to do so – like the potential $3 billion in subsidies Wisconsin gave to Foxconn to build an LCD factory there.

Given that the tariffs are aimed specifically at China, it’s more likely that Apple’s suppliers would move assembly to third-party countries where they already have production. While this would reduce the United States’ trade deficit with China, its trade deficit with the world would stay exactly the same.

Flawed response to the China challenge

There is, of course, plenty for the U.S. to complain about when it comes to China’s high-tech industry and policies, whether it’s the lack of intellectual property protection or nontariff barriers that keep major tech companies such as Google and Facebook out of the huge Chinese market. There is room for much tougher and more sophisticated bargaining to address these issues.

Trump’s trade war is based on a simplistic understanding of the trade balance. Expanding tariffs to more and more goods will weigh on U.S. consumers, workers and businesses. And there’s no guarantee that the final outcome will be good when the dispute ends.

This is a war that should never have been started.

This is an updated version of an article originally published on July 6, 2018.![]()

Jason Dedrick, Professor of Information Studies, Syracuse University; Greg Linden, Research Associate, University of California, Berkeley, and Kenneth L. Kraemer, Research Professor of Business, University of California, Irvine

This article is republished from The Conversation under a Creative Commons license. Read the original article.

14 Comments

Pingback: sexophone jazz

Pingback: แทง ROV

Pingback: ทำเว็บไซต์บริษัท

Pingback: Devops consulting

Pingback: Cornhole boards for sale

Pingback: sex boy

Pingback: https://stealthex.io

Pingback: swan168

Pingback: Pragmatic Play

Pingback: ยางยอย

Pingback: chat rooms

Pingback: ตกแต่งสวน

Pingback: Sawan888

Pingback: สล็อตเว็บตรง ไม่ผ่านเอเย่นต์ ฝากถอนออโต้