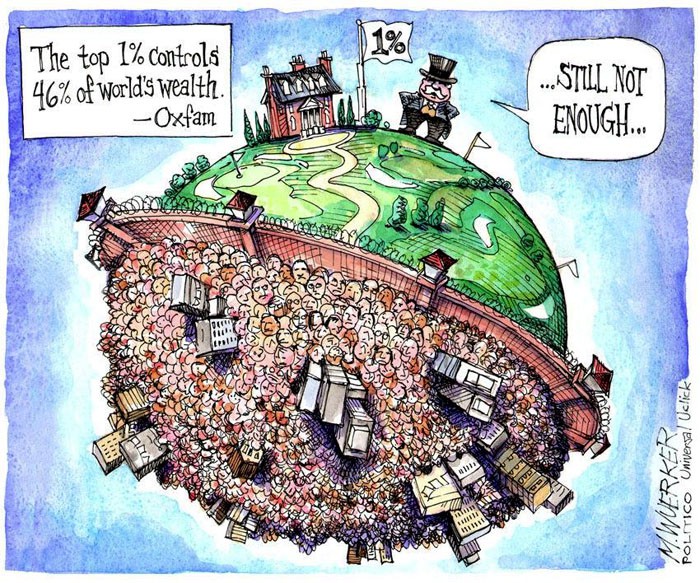

Our world’s deepest pockets — “ultra-high net worth individuals” — hold an astoundingly disproportionate share of global wealth.

Inequality has been on the rise across the globe for several decades. Some countries have reduced the number of people living in extreme poverty. But economic gaps have continued to grow as the very richest amass unprecedented levels of wealth. Among industrial nations, the United States is by far the most top-heavy, with much greater shares of national wealth and income going to the richest 1 percent than any other country.

Covid-19 and Global Inequality

Global Wealth Inequality

Global Income Inequality

U.S. Wealth Concentration Versus Other Countries

I tilfelle nokon lurar på kva gruppe dei tilhøyrer: Dei 1% rikaste eig meir enn 1 mill USD, dei 10% rikaste meir enn 100 000 USD, og dei 50% rikaste meir enn 10 000 USD. Kvar av oss “eig” i dag 260 000 USD i Statens pensjonsfond utland (oljefondet). https://t.co/I4hM2osuxu https://t.co/KAyQLt3x5G

— Tore Furevik (@ToreFurevik) November 10, 2021

Covid-19 and Global Inequality

The vaccine rollout around the globe has been rife with inequality. According to research by the Agence France-Presse, high-income nations — such as the United States and members of the European Union — have been getting much more than their fair share of vaccine doses. Despite making up only 16 percent of the global population, people in high-income nations have gotten 47 percent of all vaccine doses. That is in contrast to people in lower-income nations, who have gotten just 0.2 percent of all vaccine doses, despite making up 9 percent of the world’s population. Extreme pandemic disparities are not unique to the United States. Oxfam reports that from March 18 to the end of 2020, global billionaire wealth increased by $3.9 trillion. By contrast, global workers’ combined earnings fell by $3.7 trillion, according to the International Labour Organization, as millions lost their jobs around the world.

Global Wealth Inequality

According to the Credit Suisse Global Wealth Report, the world’s richest 1 percent, those with more than $1 million, own 43.4 percent of the world’s wealth. Their data also shows that adults with less than $10,000 in wealth make up 53.6 percent of the world’s population but hold just 1.4 percent of global wealth. Individuals owning over $100,000 in assets make up 12.4 percent of the global population but own 83.9 percent of global wealth. Credit Suisse defines “wealth” as the value of a household’s financial assets plus real assets (principally housing), minus their debts.

“Ultra-high net worth individuals” — the wealth management industry’s term for people worth more than $30 million — hold an astoundingly disproportionate share of global wealth. These wealth owners held 6.2 percent of total global wealth, yet represent only a tiny fraction (0.002%) of the world population, based on Institute for Policy Studies analysis of Capgemini and Credit Suisse wealth data and Census Bureau population estimates.

The world’s 10 richest billionaires, according to Forbes, own an astonishing $1.144 trillion in combined wealth, a sum greater than the total goods and services most nations produce on an annual basis, according to the World Bank. The globe is home to 2,755 billionaires, according to the 2021 Forbes ranking.

Those with extreme wealth have often accumulated their fortunes on the backs of people around the world who work for poor wages and under dangerous conditions. According to Oxfam, the wealth divide between the global billionaires and the bottom half of humanity is steadily growing. Between 2009 and 2018, the number of billionaires it took to equal the wealth of the world’s poorest 50 percent fell from 380 to 26.

Capgemini defines a “high net worth individual” as someone with at least $1 million in investment assets (not including their primary residence and consumer goods). The total number of high net worth individuals was more than 19 million in 2019. The vast bulk of them holds less than $5 million in assets. The Capgemini annual report shows that the top tier of these wealthy individuals, those with at least $30 million, expanded significantly in 2019 after they dipped slightly in 2018 because of a downturn in equity markets.

The Capgemini World Wealth Report shows that individuals with between $1 million and $5 million in investment assets make up the largest share of world millionaires. But those with more than $5 million hold a large majority (56.2 percent) of world millionaire wealth.

Global Income Inequality

Since 1980, the World Inequality Report data shows that the share of national income going to the richest 1 percent has increased rapidly in North America (defined here as the United States and Canada), China, India, and Russia, and more moderately in Europe. World Inequality Lab researchers note that this period coincides with the rollback in these countries and regions of various post-World War II policies aimed at narrowing economic divides. By contrast, they point out, countries and regions that did not experience a post-war egalitarian regime, such as the Middle East, sub-Saharan Africa, and Brazil, have had relatively stable, but extremely high levels of inequality.

Rapid economic growth in Asia (particularly China and India) has lifted many people out of extreme poverty. But the global richest 1 percent has reaped a much greater share of the economic gains, according to the World Inequality Report. Although their share of global income has declined somewhat since the 2008 financial crisis, at more than 20 percent it is still much higher than their 16 percent share in 1980.

U.S. Wealth Concentration Versus Other Countries

OECD statistics show that the top 1 percent in the United States holds 42.5 percent of national wealth, a far greater share than in other OECD countries. In no other industrial nation does the richest 1 percent own more than 28 percent of their country’s wealth.KKK

The United States dominates the global population of high net worth individuals, with over 5.9 million individuals owning at least $1 million in financial assets (not including their primary residence or consumer goods), as calculated in Capgemini’s World Wealth Report.

China has had the most rapid growth in the share of world millionaires, nearly doubling from 5 percent of the global total in 2017 to 9.5 percent in 2019. But 62 percent of the world’s millionaires continue to reside in Europe or North America, with almost 40 percent of these millionaires calling the United States home, according to the Global Wealth Report.

The United States is home to more than twice as many adults with at least $50 million in assets as the next five nations with the most super-rich combined. China is rising rapidly up the ranks, with the number of individuals in the $50 million club rising from 9,555 to 21,087 between 2017 and 2020, as Global Wealth Report data shows.

The United States has more wealth than any other nation. But America’s top-heavy distribution of wealth leaves typical American adults with far less wealth than their counterparts in other industrial nations, according to the Credit Suisse Global Wealth Report.

29 Comments

Pingback: virtual reality casino games

Pingback: mexican viagra 100mg

Pingback: how to buy cialis

Pingback: 40 mg cialis

Pingback: cost of 50mg viagra

Pingback: cialis coupons

Pingback: buy cialis south africa

Pingback: female viagra tablet name

Pingback: how to get viagra to work

Pingback: 1rheumatism

Pingback: ivermectin for covid

Pingback: ivermectin lice oral

Pingback: ivermectin 3 mg dose

Pingback: stromectol 12mg online

Pingback: luckylandslots.com sign in

Pingback: ivermectin price comparison

Pingback: ivermectin no prescription

Pingback: buy ivermectin uk

Pingback: stromectol usa

Pingback: ivermectine buy

Pingback: ivermectin lotion for scabies

Pingback: ivermectin tablet

Pingback: frontline doctors ivermectin

Pingback: ivermectin to buy

Pingback: ivermectin use

Pingback: tadalafil india

Pingback: stromectol 0.1

Pingback: ivermectina en ingles

Pingback: ivermectin ebay