Sandy Brian Hager, City, University of London and Joseph Baines, King’s College London

The coronavirus pandemic is rocking financial markets, disrupting supply chains and sharply reducing consumer spending. The crisis is hitting the likes of airlines and high street retailers particularly hard, and is decimating many small businesses. Unfortunately, this is proving devastating for millions of precarious and low-income workers across the world.

Many governments – including the UK and the US – have announced fiscal stimulus packages, including tax relief, to individuals and business. Such measures are welcome, but our new research suggests that they should be understood against broader shifts in the tax regime which leave society less able to withstand the pandemic.

As we show by looking at American companies, these shifts reinforce inequality not only between large and small firms but also between high and low-income households. The result is a fraying social fabric through which the coronavirus can spread rapidly.

The big discount

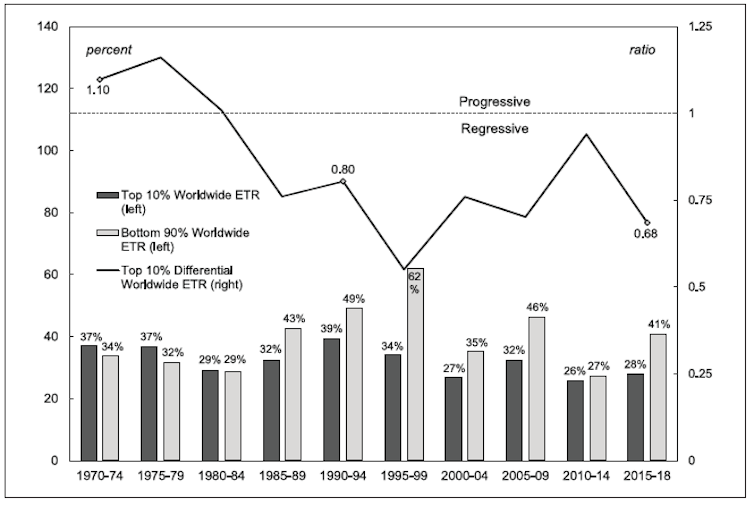

The graph below maps the worldwide effective tax rate – the rate that is really paid as opposed to any rate set by governments – for US non-financial corporations listed on the stock market. The dark grey bars show the average tax rate of the top 10% of corporations ranked by revenues, while the light grey bars show the bottom 90%. The line above the bars shows the ratio of the tax rate of the top 10% relative to the bottom 90%.

Worldwide effective tax rates

Source: Compustat/Wharton Research Data Services.

Sandy Hager/Joseph Baines

This shows that the worldwide tax system was progressive in the 1970s, with the largest corporations paying slightly higher rates than the smaller ones. By the mid-1980s the system had turned sharply regressive and has stayed so ever since. For 2015-18, smaller listed corporations were effectively paying a 41% rate on their profits, while larger corporations paid 28%.

What accounts for this persistent tax advantage for larger corporations? Are they gaming the domestic system? Or do they enjoy a foreign tax advantage because they have the resources to evade taxes and shift profits to low-tax jurisdictions? To address these questions, we compared the tax rate on domestic income to the rate on foreign income.

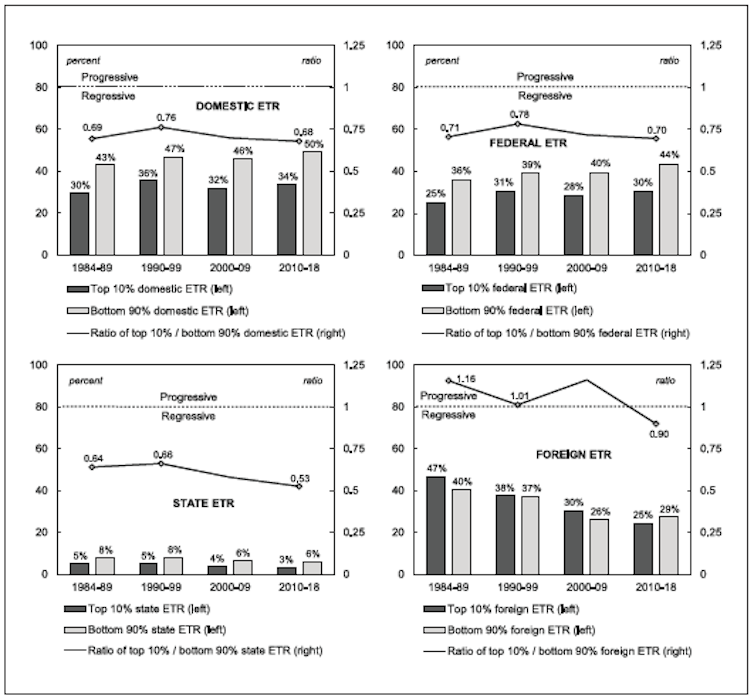

The graphs below looks at how much US corporations really pay in taxes to different authorities. Again comparing the largest 10% corporations with the rest, the top left graph focuses on tax payments in the US as a whole. The top right graph drills down to US federal taxes while the graph on the bottom left is for the total taxes paid to US states. These three graphs show that the entire domestic system of taxes, both federally and at state level, has been persistently biased towards large corporations since the mid-1980s.

Effective tax rates by jurisdiction

Source: Compustat/Wharton Research Data Services.

Sandy Hager/Joseph Baines

This is different to what American corporations pay to other countries, as shown in the graph labelled “foreign” in the bottom right-hand corner. This rate has fallen dramatically for larger and smaller corporations alike, fitting the conventional wisdom that tax competition has intensified with globalisation. Until as recently as the end of the 1990s, however, the foreign tax structure in the US was progressive, meaning that the largest corporations were paying more. This has now reversed, just like it did for domestic taxes several decades earlier.

Concentration and inequality

Why should we care if big business has a persistent tax advantage? One problem is that the tax system encourages businesses to concentrate into bigger and bigger entities. In recent years there have been growing concerns about the dominance of big business in advanced economies, including the US. Studies show that as large corporations take greater shares of revenues, profits and assets, they also charge higher prices, pay lower wages, provide lower quality goods and services, and scale back innovation and investment.

Most policy debate has focused on governments rolling back antitrust legislation to remedy this concentration of businesses. Our research suggests that, at minimum, corporate tax should be part of this conversation: the global tax system rewards corporations for reaching a size that is actually bad for society. This may include impeding our ability to mitigate the spread of coronavirus.

Take the notoriously concentrated pharmaceuticals sector, which was already being blamed for a growing problem of drug shortages well before the arrival of the pandemic – partly due to business decisions to discontinue old products that wereren’t profitable enough. Lobbyists for big pharma were also successful in blocking provisions in a new US$8.3 billion (£6.7 billion) coronavirus emergency spending bill that would tackle unfair pricing and thus threaten companies’ intellectual property rights over essential medicines.

Drug shortages threaten added difficulties. Daniel Farer Paez

The tax advantage of big business also helps to widen household inequality. Supporters often claim that tax savings allow business to expand productive capacity, employment and wages, and therefore create widespread prosperity. Yet our research shows that as the rate they effectively pay declines worldwide, large corporations scale back their capital expenditures.

If large corporations aren’t using their tax windfall to expand productive capacity, what are they doing with it? According to our findings, they are enriching their shareholders.

In the 1970s, large corporations allocated 30 cents toward dividend payments and stock buybacks for every dollar of capital expenditure. From 2010-18, the amount they spent on enriching their shareholders had jumped to 93 cents.

This surge wouldn’t be such a problem if share ownership was widely dispersed, but it’s not. The top 1% of US households own, either directly or indirectly, 40% of all corporate shares, and the top 10% of households own 84%.

So the corporate tax regime has fuelled inequality, which is an important vector for the spread of the coronavirus. Many people on lower incomes are forced to make the wrenching choice between going into work and potentially contracting and spreading the coronavirus, or staying at home and failing to make ends meet.

The government measures for individuals and small businesses are a welcome – but by no means sufficient – attempt at ameliorating problems that the regressive tax regime has helped to create. Let’s also use this crisis as an opportunity to reform the tax system in ways that help tackle inequality and reduce corporate concentration.![]()

Sandy Brian Hager, Senior Lecturer in International Political Economy, City, University of London and Joseph Baines, Lecturer in International Political Economy, King’s College London

This article is republished from The Conversation under a Creative Commons license. Read the original article.

32 Comments

Pingback: hydroxychloroquine treatment protocol

Pingback: hydroxychloroquine 200mg pills

Pingback: hydroxychloroquine prescription

Pingback: where to buy hydroxychloroquine near me

Pingback: mexican ivermectil generic

Pingback: cephalexin stromectol

Pingback: priligy for sale in us

Pingback: ivermectin 6mg capsule

Pingback: buy ivermectin

Pingback: stromectol prostatitis

Pingback: sterapred use

Pingback: stromectol 6mg capsule en español

Pingback: ivermectin from mexico

Pingback: buy stromectol online

Pingback: The World's Sustainable Gazette - Bergensia.com - Bergensia

Pingback: The World's Sustainable Gazette - Bergensia

Pingback: ivermectin cost

Pingback: generic cialis vs brand cialis

Pingback: clomid for women price

Pingback: ivermectin cancer dose human

Pingback: generic stromectol (ivermectin)

Pingback: ivermectin egg withdrawal

Pingback: sildenafil otc uk

Pingback: viagra 50 mg

Pingback: online pharmacies

Pingback: order cialis without a prescription

Pingback: hydroxychloroquine over the counter for sale

Pingback: best viagra over the counter

Pingback: stromectol soolantra for sale

Pingback: canadian pharmacy generic tadalafil

Pingback: best viagra alternatives over counter

Pingback: Bergensia just passed a 1000 articles - Bergensia